Are you Aware of Broomfield’s missteps with Retail Marijuana?

As of May 3rd, 2021, retail marijuana licenses became legal in Broomfield. Are you also aware that Broomfield citizens passed a special sales tax on marijuana in November, 2020?

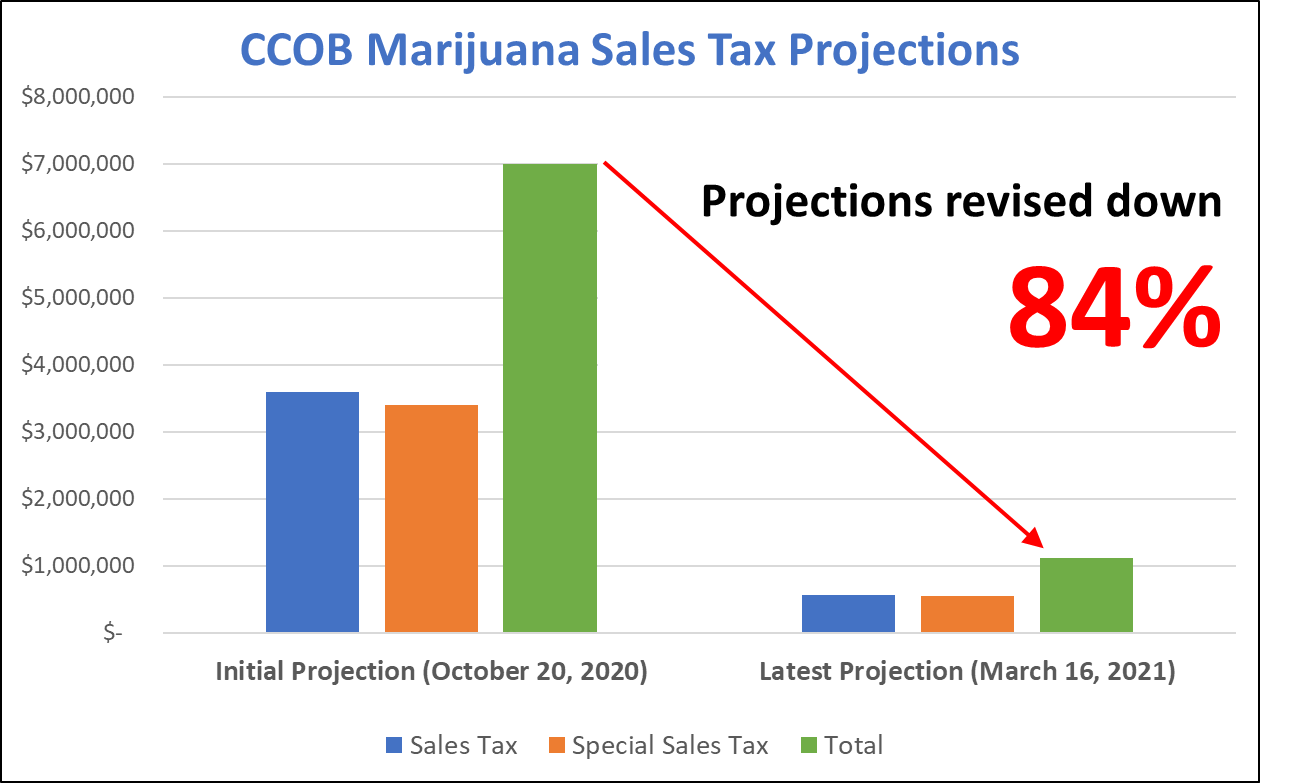

The Broomfield City Council’s main rationale behind pushing for their special marijuana sales tax was to make sure that Broomfield gets its “fair share” of those taxes, with the CCOB’s initial estimates as high $7 million annually. One would think that the City and County of Broomfield (CCOB) is already benefiting mightily with the influx of new taxes.

Fast forward to today, what is abundantly clear is that this is not panning out as planned for the CCOB. In fact, the marijuana retail shop selection and licensing process has been fraught with fits and starts. Broomfield taxpayers are on the hook for increased staff time spent, including the City Attorney office’s time defending Broomfield against multiple lawsuits from applicants, to implement marijuana sales in Broomfield – The costs for which have not been quantified by the CCOB.

This is the latest example of a poorly thought out and executed policy from the City Council and the City and County of Broomfield.

Which raises the question: For the unknown amount of tax dollars spent thus far just to start up marijuana sales in Broomfield, with no guarantee that marijuana sales can be done in a way that protects public health and safety of our community, how is this good for Broomfield?

The CCOB is in the process of selecting and licensing three retail marijuana shops in an effort to realize the Broomfield City Council’s dream of getting its “fair share” of marijuana sales taxes. So, what do those sales taxes really look like, and what is it costing the CCOB?

Broomfield voters were sold a bill of goods on sales tax projections.

Over the last year and a half, The CCOB has attempted to project the taxes from marijuana sales which will be collected through the Broomfield sales tax (4.15%) and a special sales tax (4.0%). CCOB sales taxes projections from October 20, 2020 were just over $7 million.

In November 2020, Broomfield Voters approved a ballot initiative to authorize the CCOB to collect a special sales tax on marijuana sales. Since the ballot initiative was approved, the CCOB’s projections have been reduced considerably. On February 23, 2021, The CCOB re-iterated its projection of $7 million consisting of “…both the Broomfield sales tax (4.15% or $3.6M) and the approved Special sales tax (4.0% or $3.4M)”. (see page 3)

Less than a month later, on March 16, 2021 the CCOB dramatically revised the projected sales taxes to $1.1 million (slide 8). This estimate was for five marijuana retail stores – two of which could come 12 months after the first three stores are licensed.

The CCOB projections have varied wildly by more than 84%, and may be off by even more. So why is the CCOB continuing to pursue bringing in sales taxes that would make up 0.7% of the CCOB operational budget?

Implementation costs cannot be estimated, and operational costs are yet to be validated.

The selection and licensing process that the CCOB is implementing has been riddled with mismanagement, missteps, and multiple legal challenges. In fact, the selection process has been “paused” twice in October 2021 and December 2021 due to these issues.

The first lawsuit against the CCOB was filed September 2021 by Centroid Holdings, Inc, claiming that certain applicants were undermining the fairness of the selection process.

A second lawsuit was filed against the CCOB in February 2022 by Star Buds LLC, claiming the city’s Selection Committee made errors in finding that the company didn't meet the criteria and that the claim against one of the board members is inaccurate. The second lawsuit is making its way through the courts, and the CCOB Selection Committee’s Application Merit Approach and Findings are available here.

Further, the CCOB cannot seem to quantify the initial effort and costs related to establishing retail marijuana sales in Broomfield. A number of employees across multiple departments serve on the Selection Committee, working along with the City and County Clerk’s office and City’s Attorney’s Office. It’s very concerning that the CCOB cannot put a number on how much time, effort, and money has been spent thus far.

Looking at the CCOB’s March 2021 projections, the city is expecting a first year expense of $112K for Program Administration, Enforcement Training, and Dedicated Personnel. It is safe to say that the actual expenses will be much higher once the program is in place, making the allure of retail marijuana sales in Broomfield less and less attractive.

So what can you do?

Ask questions…lots of them…to the Broomfield City Council and City and County of Broomfield.

How much has the CCOB actually spent on establishing marijuana sales in Broomfield?

Will the CCOB audit the sales taxes, upfront costs, and ongoing expenses for administering marijuana sales in Broomfield?

How much has the City Attorney’s office spent developing the ordinance for retail marijuana sales and defending Broomfield against litigation related to the marijuana licensing program?

What is the REAL expected sales taxes from marijuana sales in Broomfield?

Most importantly, how will marijuana sales benefit Broomfield?

The pie in the sky projections on sales tax revenues are falling apart, and the costs that the CCOB is incurring with staff time and legal fees are piling up, but the CCOB has not yet quantified what those costs are.

Using Broomfield tax dollars to continue down this path is hurt our community as it is distracting from public safety, rising crime, and a community that continues to struggle to come back economically from other local and statewide policies.

It’s time to for the CCOB to step back and re-think what the real benefits are to be gained from retail marijuana sales in Broomfield. The juice is not worth the squeeze.