Property Tax Details

Last Updated: June 2, 2023

The highest property taxes in Colorado are not an unfortunate accident. They are the direct result of the things the State Legislature and your City Council either attempted or succeeded implementing in the past. Policy has direct implications to the economy. We will provide you a history and some recent observations in the details below.

“It is not true that the legislator has absolute power over our persons and property. The existence of persons and property preceded the existence of the legislator, and his function is only to guarantee their safety. It is not true that the function of law is to regulate our consciences and ideals, our wills, our education, our opinions, our work, our trade, our talents, or our pleasures. The function of the law is to protect the free exercise of these rights, and to prevent any person from interfering with the free exercise of these same rights by any other person.”

-

Property Tax Calculation

It is important you know how your property taxes are used to support Broomfield. We will show you how to find your tax area and the corresponding mill levies for your area. We will also show you how the state’s residential assessment rate (RAR) and your mill levy are used to calculate your property taxes.

-

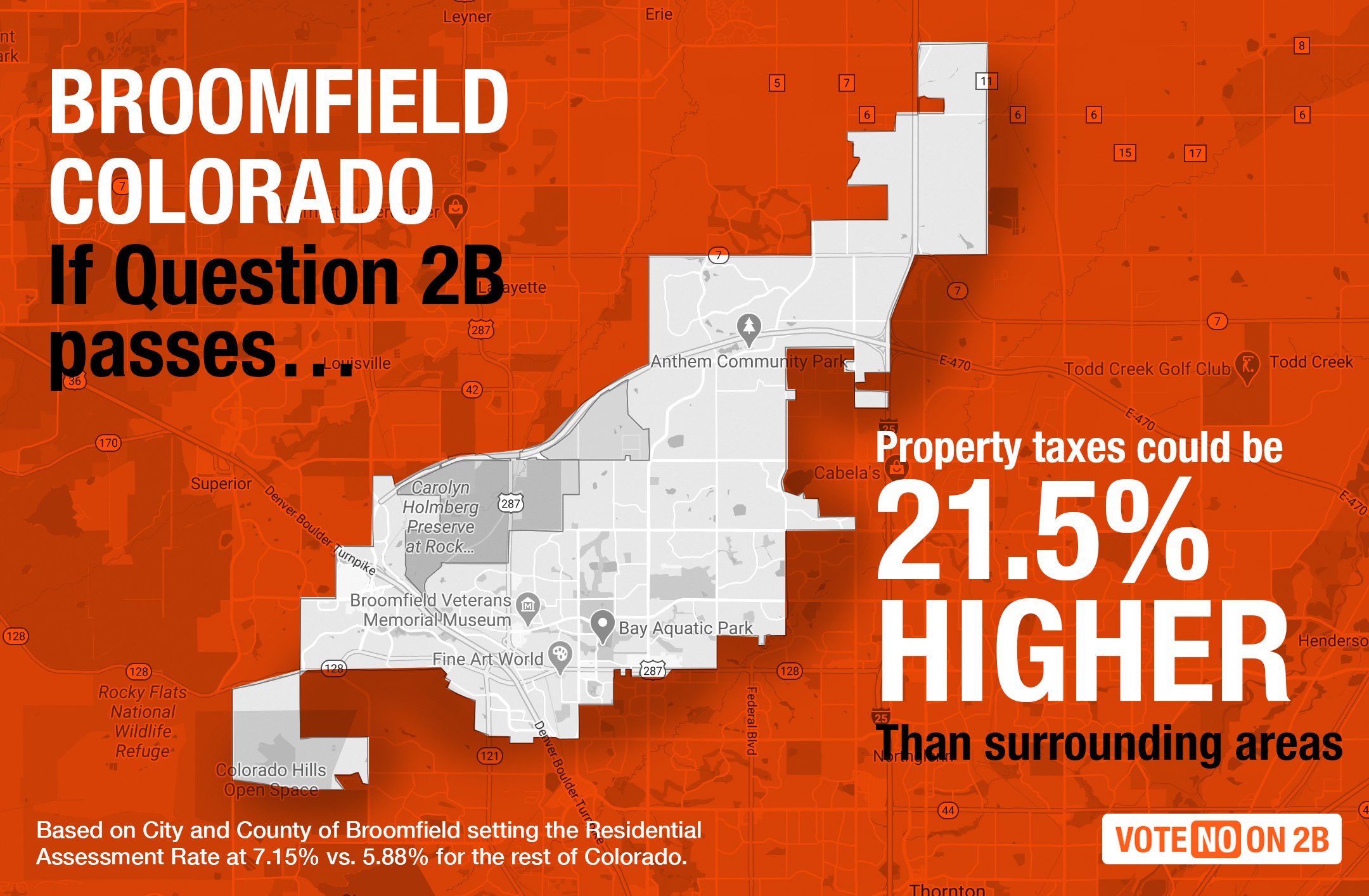

History-Vote No on 2B

The “Vote No on 2B” issue committee ran a campaign against Amendment 2B here in Broomfield in 2020 and also tried to educate taxpayer on the consequences of Amendment B at the state level, also known as the Gallagher Amendment. This section describes the Gallagher formula, how it helped you, and the consequences of the repeal.

-

State Legislature Meddling

Your state legislator put Amendment B / Gallagher Repeal on the ballot. You didn’t ask for a change. They’ve interfered many times to try to “fix” their interference. This section explains the bills that were introduced and their impact to your property taxes.

-

Take More, Spend More

What caused your property taxes to skyrocket? The Federal Government has printed a lot of money in the past 10 years. Your state and local government keeps adding taxes, fees, and regulations taking money out of your pocket. Proposition HH is another way for them to take your TABOR refund from you forever and make you pay the highest property taxes. Taking more money from you, doesn’t result in more affordability, the result is less affordability for you.

Property Tax Calculation

Broomfield is broken into five Wards with a variable number of Precincts per Ward, with an approximate equal number of residents per Ward. Within Broomfield there are also tax areas. You can zoom into this map (as we’ve shown in the image) and find the number corresponding to your tax area, or you can look on your notice of valuation from the assessor’s office and it will be shown in the columns before the breakdown of your valuation. You can find your mill levies associated with your tax areas here.

As an example, the mill levies for tax area 145 are shown by the image on the left. In tax area 145, the mill levy consists of monies that will go to the City and County of Broomfield (28.968 mills), the Adams 12 School District (73.51 mills), Urban Drainage and Flood (0.726 mills), and the North Metro Fire District (14.73 mills). 1 mill is equal to $1 in property tax levied per $1,000 of a property's assessed value.

To calculate your property tax, back in 2020, here was the calculation: Take your property value, multiply that by the RAR of 7.15%. This will give you the assessed property value. Take the assessed property value and multiply that by the mill levy, divided by 1000, for your tax area. That will give you your property tax.

In 2022, the state legislature passed SB22-238, which gave you a $15,000 reduction in your property value and then applied a 6.765% RAR. On a $500,000 property, the property tax would have been $3869. However, property taxes rose approximately 40%, so your $500,000 property is now worth about $700,000, raising your property tax to $5465.

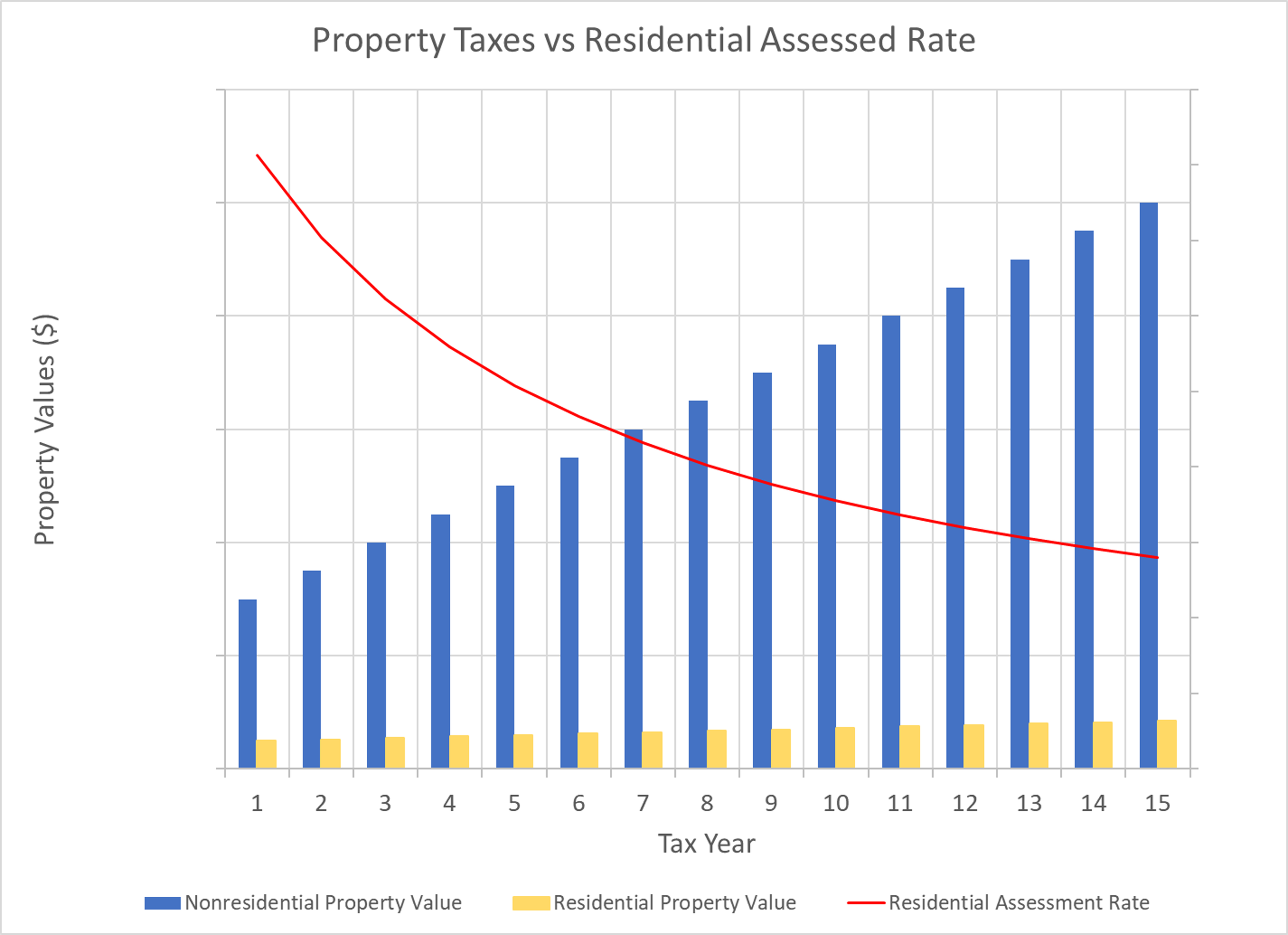

Gallagher Repeal/Amendment B and Broomfield Amendment 2B

Property Taxes were high back in the late 70s and early 80s due to inflation. In 1982, the Gallagher amendment was passed with 65% support of the legislature to address the issue of inflated property values. Ask yourself this question. Why should the government get 40% more property tax just because your home value increased due to inflation, which the government caused? The Gallagher Amendment addressed two types of properties: residential and non-residential. The Gallagher Amendment set the non-residential assessment rate to 29%. The residential assessment rate is fixed at 45% of total property values. The graph, shown to the right, illustrates how the RAR changes as property taxes for both non-residential (blue bars) and residential (bars) increase over time.

The State Legislator initiated the Amendment B/Gallagher Repeal in 2020. At the same time, the City Council of Broomfield “decided” to run a concurrent ballot initiative, Amendment 2B, called the “Revenue Stabilization Act”. This amendment intended to raise mill levies, with voter approval. The exact language said, “Shall the City and County of Broomfield be able to annually adjust its future mill levies for tax collection year 2022 and thereafter for the purpose of maintaining property tax revenues that would otherwise be lost as a result of adjustments,…” The City Council told you, at the time, that if “Question 2B” did not pass, we faced disaster. Our library would close, the fire department would fail, and critical infrastructure projects could be delayed and they wanted to do that without having to come back to you for future increases.

The “Vote No on 2B” campaign told you that if the Gallagher Amendment was repealed and Broomfield’s 2B passed your property taxes were going to go up. The projection at the time was that property taxes would go up 21.5%. Unfortunately, estimates were low and as we now know that property taxes have increased anywhere from 33% to 51% higher than surrounding areas.

The “Vote No on 2B” campaign showed you, from the city’s own 2021 budget presentation on slide 43, how they expected their spending to increase, not decrease. They didn’t see or understood how you were hurting financially. They decided they needed your money more than you did. You, the voters, confronted them about their claims, and saw past the smoke and mirrors and 70% of you voted against 2B.

Remember back in 2020, when the Covid-19 pandemic kept people locked down and the City Council shuttered small businesses? The City Council told you their sales taxes were down 20.8% because of their decision, however, property taxes were up by 11.5%, both of which provide revenue for the city. You were hurting financially, businesses were struggling, and your City Council said they needed the money.

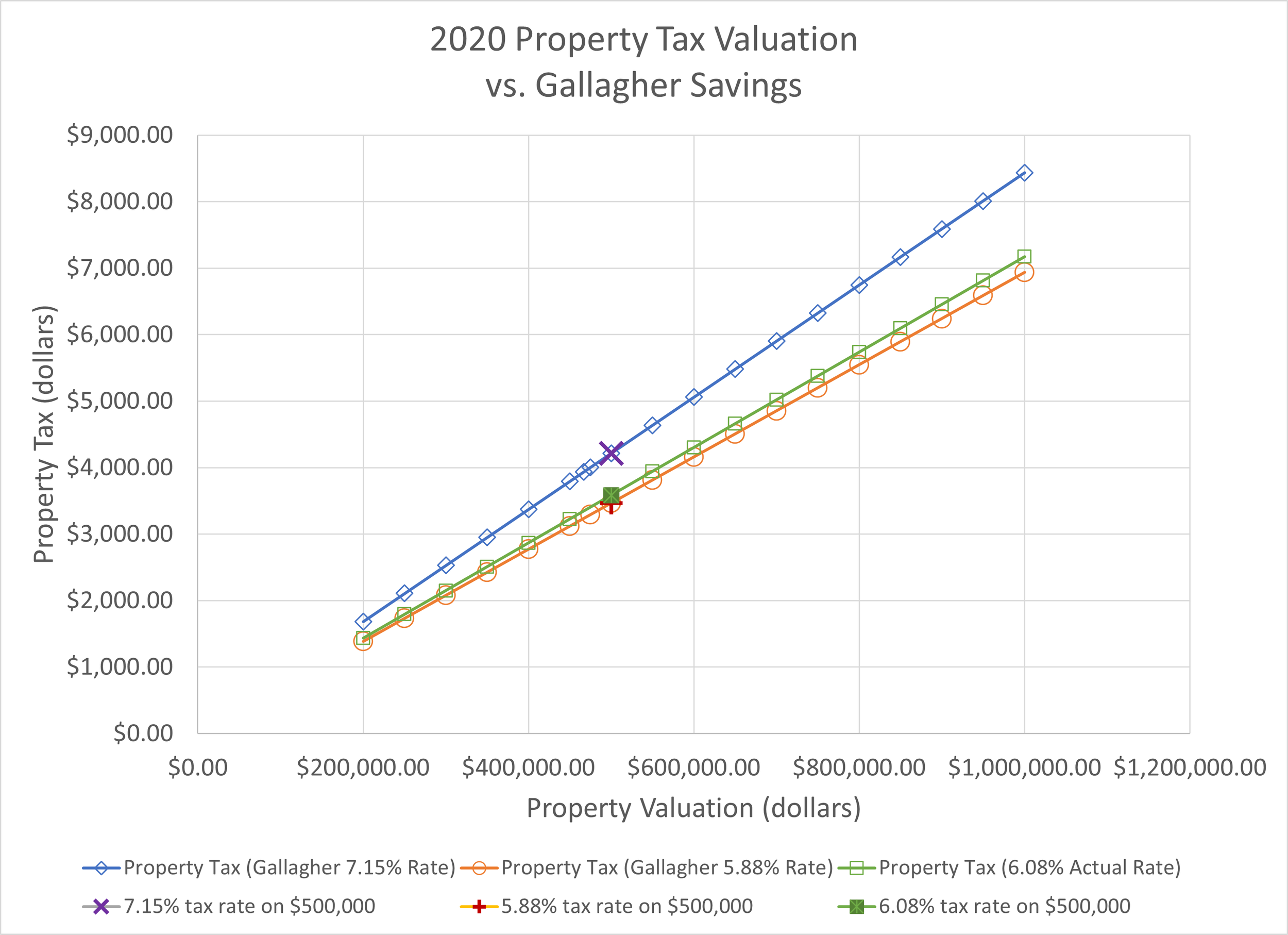

Back in 2020, the “Vote No on 2B” campaign showed you what would happen to the property taxes if Gallagher was repealed. Estimates were that the RAR would have gone down to 5.88%. The campaign showed you that for a $500,000 home, your property tax would have decreased from $4216 at the 7.15% rate (blue diamonds) to $3467 at the 5.88% rate (orange circles). A savings of $749 per year. And as property taxes increased, the savings would have been larger as shown by the graph on the right. Due to a different value of the total property taxes, the actual RAR was re-calculated to be 6.08% (green squares), however, the voters repealed Gallagher and the assessment rate remained at 7.15%.

So what has happened to the City and County of Broomfield’s Revenues and Expenditures since 2020? Are they hurting?

The dark orange bars are what was predicted before the “Vote No on 2B” campaign and were reproduced from slide 43 of the City and County's 2021 Budget Presentation. The light orange bars are from slide 34 of the City and County's 2023 Budget Presentation. (RB > Revised Budget, B > Budget, PB > Projected Budget, F > Forecasted Budget). We include the revenue graph, because we want you to know that they have not fallen short on collecting property taxes, sales and use taxes, charges for other services, and other intergovernmental sources. The difference in revenues in 2022 was 23.4%, and in 2023 it is expected to be 8.2%. The expenditures in 2022 increased by 17.6%, and in 2023 they are expected to increase by 16.3%. All these numbers are much higher than the rate of inflation.

What happened with the library being closed, and fire district failing, and critical infrastructure projects that were going to be put off? The reality is, each of these has moved ahead without missing a beat. The City and County of Broomfield's revenues and expenditures have continued to increase, and at a rapid rate.

The scramble to fix the fallout from the Gallagher Repeal…

What happened between the repeal of the Gallagher Amendment and 2023?

The following bullet points are a few things attempted since 2020 through Propositions and Legislation to avert the coming catastrophic property tax increases.

2021 - Proposition 120 and SB21-293

A citizen’s initiative, Proposition 120, was placed on the ballot in 2021 to try and limit the property tax increases for 2023 and 2024 for real residential property.

This Proposition would have reduced the Residential Assessment Rate (RAR) from 7.15% to 6.5% and would have allowed the legislature to retain $25 million from TABOR over 5 years to send to local government to make up for their losses.

Before the vote, the state legislature passed SB21-293 (see image below) changing the definition of residential real property to eliminate single-family homes and include only multi-family homes. This bill changed the ballot initiative language and proposition 120 lost. However, in this bill, they reduced the RAR from 7.15% to 6.95%, hoping you would give them credit for this tiny reduction.

2022 - SB22-238 - Another attempt to “help” you

In 2022, property taxes had begun to rise sharply and the legislature decided they needed to take further action so that you would keep them in office.

They passed Senate Bill 22-238 reducing property values by $15,000 before applying an Residential Assessment Rate (RAR) of 6.675%.

This bill resulted in a slightly higher tax bill than Proposition 120 would have done. Proposition 120 would not have reimbursed local governments for lost funds.

SB22-238 required to take money from you and reimburse local municipalities. They gave you some relief on the one hand, and picked your pocket with the other hand.

Your state legislators have realized that property taxes are going to skyrocket and so two bills along with 5 citizen initiatives were introduced at the beginning of this legislative session. They were hoping they could save themselves from your anger.

2023 - Still trying to fix their egregious mistakes

HB23-1054 would have kept RARs at around 6.922% but failed in committee along party lines with one democrat voting on the Republican’s side.

SB 23-108 attempted to make it legally viable for local municipalities to issue tax refunds. This option is already available in the state constitution. The bill wouldn’t have reduced the overall tax burden on you and would have taken your refund money from TABOR and given it to you as tax relief. The bill only applied to 11 of 64 counties.

Citizen Initiatives 35 to 38 would have capped property taxes at 3% per year or inflation rate, but would have also eliminated TABOR refunds. The initiative would have asked you to give up $3 for every $1 you save.

Citizen Initiative 21 would have capped property tax increases to 3% per year or inflation. It would also give us a $700M property tax break in exchange for $100M, from out TABOR refunds, to backfill local municipalities. However these citizen initiatives wouldn’t take effect until 2024.

At the last moment, in this year's legislative session, they threw together SB23-303. This bill, also known as proposition HH in the bill language gives you only two option: (1) a NO Vote to increase your property taxes by the largest amount in the history of Colorado, and (2) a YES vote will increase your property taxes by the largest amount minus a refund to you from TABOR, but would force you to give up TABOR refunds forever. We encourage you to read the bill, it is very complicated. There are also glaring errors with the bill.

Text from SB21-293 showing how the state legislature struck-through language used to apply RAR to residential property.

Text from SB22-238 showing the $15,000 reduction and 6.765% RAR for real residential property.

Here is a graph showing how your property taxes were impacted by each bill passed by the state legislature. If Gallagher had not been repealed, your RAR would have been reduced to 6.08% and your taxes, per year, would have been reduced by $631 for a $500,000 property. SB-293 reduced your property tax, per year, by $118 or approximately $10 per month.

By 2022, property values had begun to rise dramatically, and the state legislature was scared they would lose your vote, if they didn’t act, so they passed SB22-238, which lowered the tax rate to the present value of 6.765% and a $15,000 subtraction from your property value, but by now your property was worth about 40% more and a $500,00 was now worth $700,000 (orange bars), so if your property value was still $500,000, your property tax would have been $3869, but now because your home is worth more, your property tax is now $5465, an increase of $1596, or $133/month.

“When a business or an individual spends more than it makes, it goes bankrupt. When government does it, it sends you the bill. And when government does it for 40 years, the bill comes in two ways: higher taxes and inflation. Make no mistake about it, inflation is a tax and not by accident.”

Government is the problem…

Federal Government

Government doesn’t generate income. It does not sell anything for profit and therefore their only source of income is YOU. If their revenues increase it is because they take more money from you leaving you with less money to spend for your needs. This is where inflation comes from. The government is competing with you for products and services. The revenue and spending graphs show you how federal revenues and spending have increased since 2015. The third graph shows you the United States inflation rate from 2000 to 2023.

Federal Government Revenues was fairly constant before 2020. It rose by $1 trillion (T) between 2020 and 2022.

State Government

Federal Government Spending was $5.4T in 2019, $7.47T in 2020, $7.38T in 2021, and $6.27T in 2022. Notice how spending in 2020, 2021, and 2022 was more than revenue?

The Colorado State Government has also seen increased revenues and expenditures. All of the data presented in this section can be found at the Colorado State Budget website.

This graph shows that total revenues were about $55.9 Billion for fiscal year (FY) 2020-2021, 25% went to the general fund, 31% went to the Cash Funds, and 44% went to the Federal Funds.

This graph shows that total spending budget was about $36.5 Billion for fiscal year (FY) 2022-2023. Again the spending has increased dramatically since 2012.

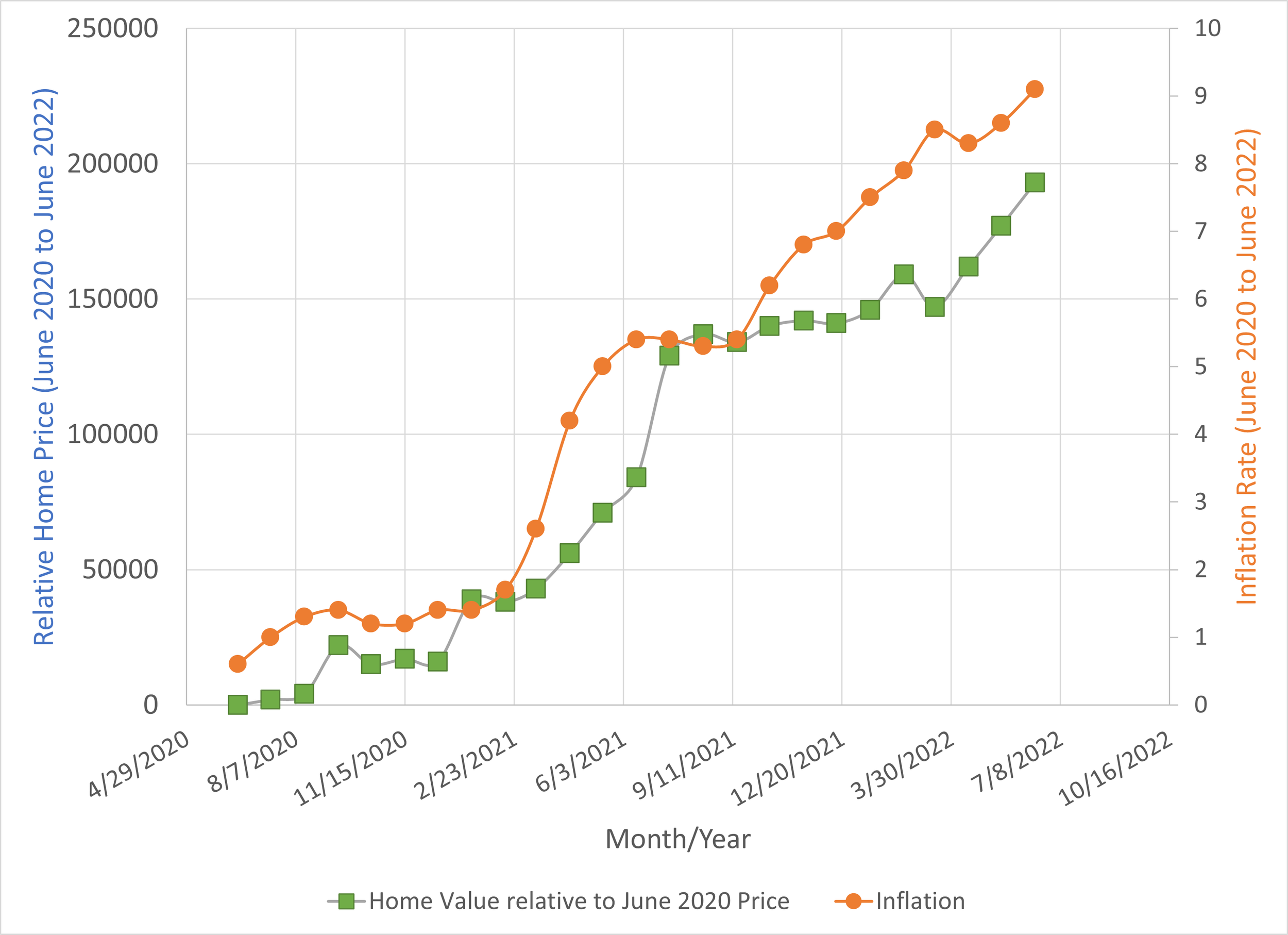

We’ve seen in a section above that local revenues and spending have increased dramatically. All of this spending at every government level translates to the inflation we see in our current economy. So is inflation correlated to the rise in our property taxes? Look at the graph to the right. The green trace shows relative home values for a single property in Broomfield and the orange trace shows the inflation rate.

Suggested Actions:

The U.S. inflation rate rose in 2021 after the increased spending by the government began in 2020. These are year-over-year rates.

These are the taxes you pay to the state government. This represents about 25% of the total state budget. Look at the dramatic rise in FY2017-2020.

The TABOR Amendment, approved in 1992, limits the amount of revenue the state can retain and spend, including revenue from most taxes and some fees. Any revenue that comes in above the limit is refunded to taxpayers.

The correlation for this property was 97% which is statistically significant. We tested other properties in Colorado and found correlation rates from 84% to 98%. So it appears your government is the source of your inflated property values. So what is the solution for them? Take more of your money and take away your taxpayer protections FOREVER!

Proposition HH, supported by Governor Polis, is a very bad bill for Colorado taxpayers…

After all the bad bills passed by your state legislature over the past few years, Proposition HH, was passed hastily in the last week of the FY2022-2023 session. Let’s look at parts of the fiscal summary.

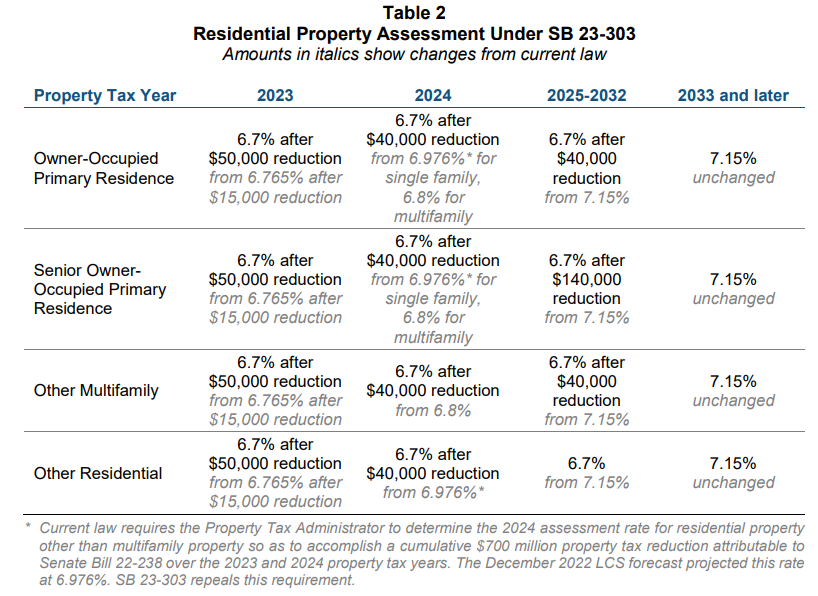

Table 2 shows you how your residential assessment rate (RAR) will be set starting in 2023. Notice in 2024, single family homes will be assessed at a higher rate that multi-family homes. In 2033, the RAR will return to 7.15%.

This is the language in Proposition HH that will allow the state to “retain revenue that would otherwise be refunded to the taxpayers”. In other words, they not only get increased property tax revenue, they will be allowed to tax you above the TABOR limit and keep it.

Oppose Proposition HH on the November ballot - Just Say NO!

Write Governor Polis and tell him to call a special session to fix their mess!

Tell the Broomfield City Council to lower their mill levy from 28.868 mills to 20 mills.

Their current portion for a $700,000 property (40% increase on $500,000) is approximately $1342

A drop to 20 mills would generate approximately $1003 for their fund and save you approximately $340

$1003 generated on an inflated price of $700,000 is about $50 more than the City and County of Broomfield would have retained under SB22-238 for a $500,000.